Short-Term Rentals: Regulations, Taxes, & Transition Strategies

Podcast Interview – Discover the secret to thriving in short-term rentals with Kris McEvoy’s strategies for navigating regulations and maximizing revenue.

Browse the latest from Leap | ACT.

Podcast Interview – Discover the secret to thriving in short-term rentals with Kris McEvoy’s strategies for navigating regulations and maximizing revenue.

The Underused Housing Tax is an annual 1% tax on the ownership of vacant or underused housing, specifically residential property.

An accountant can be an asset when it comes to payroll. They can assist with set-up, calculation, compliance, and provide financial insights.

As a small-medium-sized business owner in Ontario, it’s crucial to keep up with the ever-changing HR laws and regulations.

Discover the key differences between RRSP and TFSA, and learn how to maximize the benefits of these accounts to reach your financial goals with our expert consultation.

Not sure if you should contribute to an RRSP? An RRSP contribution can be a valuable part of a long-term savings and retirement strategy.

When you sign up for Xero cloud-accounting software, you also receive a free subscription to a superb app called Hubdoc.

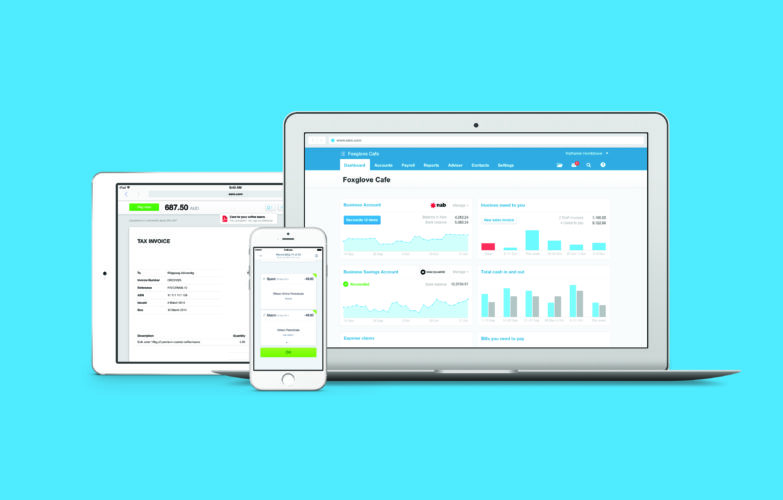

While many Canadians are most familiar with QuickBooks Online, it’s not our favourite. Learn why we choose Xero Cloud-Accounting Software.

Learn why cloud-based accounting software is a better alternative to using old desktop accounting programs.

Contact-free virtual meetings are available at the click of a button.

Book A Consultation