Updated ( April 21, 2020) Canada Emergency Wage Subsidy (CEWS) – For eligible employers, the subsidy covers up to 75% of an employee’s wages for employers who have suffered a drop in gross revenues of at least 15% in March, and 30% in April and May. It was announced this morning that applications with open for this program on Monday, April 27th.

Canada Emergency Response Benefit (CERB) – For eligible employees and self-employed individuals, the subsidy provides $500 a week for up to 16 weeks if you have stopped working because of COVID-19.

Canada Emergency Business Account (CEBA) – This program will provide interest-free loans of up to $40,000 to eligible small businesses and not-for-profits. Business owners can apply for support from the Canada Emergency Business Account through their banks and credit unions

More time to pay income tax – Businesses are allowed to defer, until after August 31, 2020, the payment of any income tax amounts that become owing on or after March 18 and before September 2020.

Canada Emergency Commercial Rent Assistance – The program was announced by the Federal Government on April 16th, but collaboration with the provinces is needed in order to set it up. The support is expected to be available for April, May and June rents. It was proposed that government would be offering loans, including forgivable loans, to commercial landlords who offer rent reductions to businesses. Refer to the website link to watch for more details.

Local supports – deferrals on property taxes, utilities including water and wastewater, etc. Please review the site for information on your municipality.

Latest Update (April 15, 2020) – Click Here »

Click the link above to read the latest update from the Federal Government of Canada.

In response to the coronavirus pandemic and the resultant job losses and financial uncertainty for Canadians countrywide, the federal government announced the Canada Emergency Response Benefit (CERB) to help those affected tide over the next few months.

Updated April 3, 2020

What is the CERB?

- The CERB is a taxable government payment meant to temporarily help those grappling with job loss or other circumstances that have resulted in sudden loss of income due to the COVID-19 pandemic.

- It offers $2000 per month and is paid in blocks of four weeks, which amounts to $500 a week. A maximum of 16 weeks or four months of benefits can be paid.

- The CERB is available from March 15 to Oct. 3, 2020. You can apply no later than Dec. 2, 2020. Your payments will be retroactive to your eligibility date.

- Benefits will start within 10 days of you submitting an application. There is no waiting period.

- While the benefits are taxable, tax is not deducted when it is paid to you. You must report the CERB payments as income when you file your taxes for 2020.

Who can apply for the CERB?

You can apply for the CERB if you:

- were let go from your job, your hours have been reduced to zero and you and do not have paid leave or other income support

- were let go from your job and are eligible for Employment Insurance – regular or sickness benefits

- still have your job but have been temporarily laid off and asked not to come to work

are sick or quarantined – you do not need a medical certificate as proof - are taking care of someone who has contracted COVID-19

- are a working parent who has to stay home, without pay, to care for your children or other dependents whose care facility is closed

- are self-employed and would not otherwise qualify for employment insurance (EI)

- are a contractor and would not otherwise qualify for EI

What are the criteria to apply for CERB? - The CERB is only available to those who have stopped working due to reasons related to COVID-19.

- If you are currently looking for a job, you are not eligible for the benefit. For example: students who may have had a job last year and were planning on working this summer do not qualify.

To apply for CERB you must fulfill the following criteria: - You must reside in Canada and be at least 15 years old

- You must have a valid social Insurance Number

- You must have stopped working because of COVID-19 related reasons or are eligible for Employment Insurance – regular or sickness benefits

- You had income of at least $5,000 in 2019 or in the 12 months prior to the date of applying for CERB. This can be from employment, self-employment, maternity/paternal benefits under the EI program or a combination of those sources.

- You expect to be without employment or self-employment income for at least 14 consecutive days within the first four-week period. For the rest of the benefit periods, you expect to have no employment income

If you are not a citizen or a permanent resident, you may be eligible to receive the CERB if you meet other eligibility requirements – including international students and temporary foreign workers.

What documents do I need to submit?You do not need extensive documentation immediately to apply for the CERB.

You will need to provide:

- You personal contact information

- Your Social Insurance Number

- You’ll need to confirm you meet the eligibility requirements.

- You could be asked to provide additional documentation to verify your eligibility at a future date.

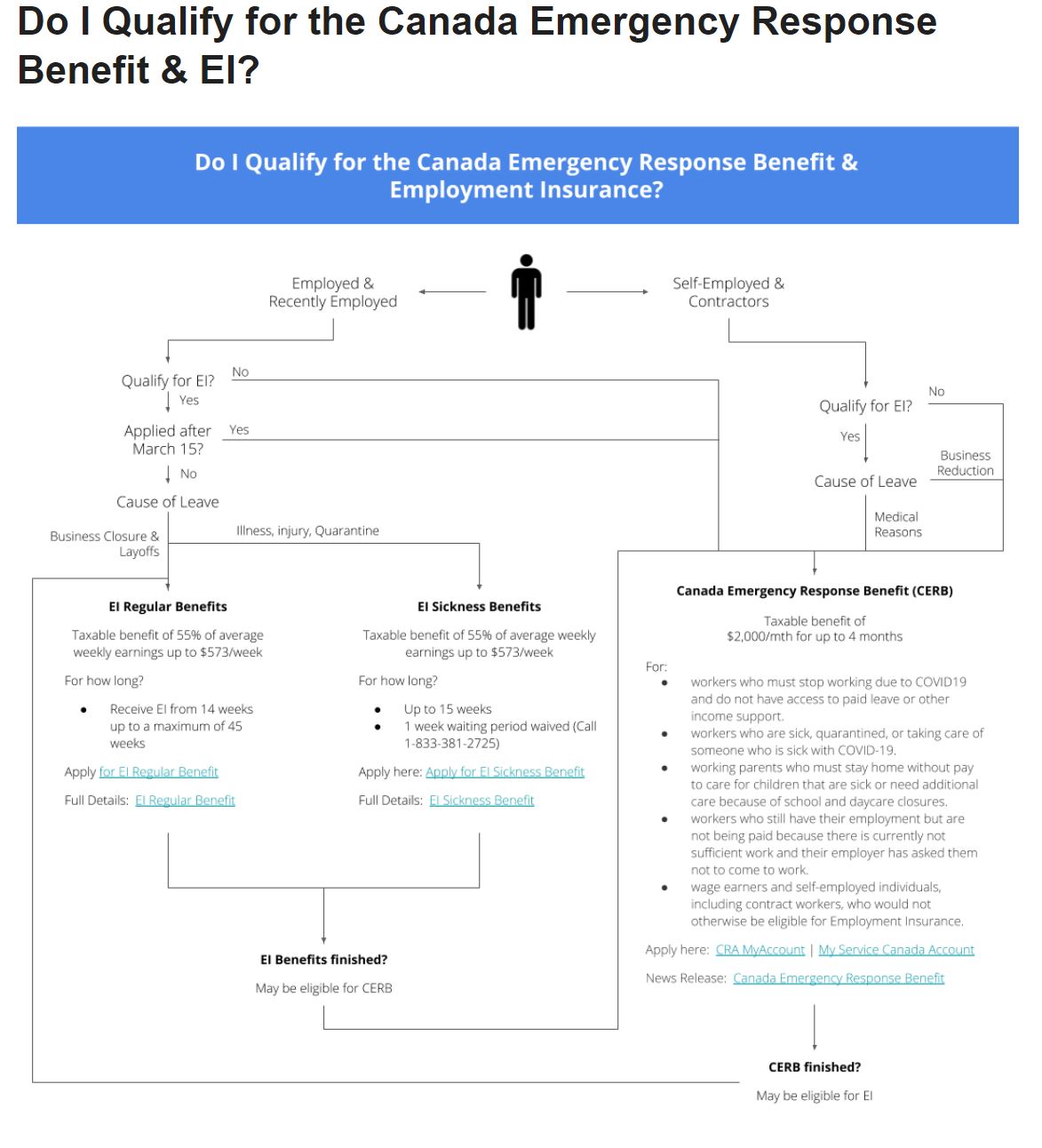

CERB vs EI

If you have stopped working because of COVID-19, you should apply for the CERB whether you are eligible for EI or not.

On April 6, the federal government is launching a single online portal to assist with the CERB application process. Until then, if you have lost your job and are eligible for EI, you can continue to apply for it.

In addition, you should also continue to apply for other EI benefits like maternity leave, parental leave, caregiving, fishing and worksharing as applicable to your situation.

- Whether you receive EI or CERB depends on when you became eligible for EI:

- If you are already receiving EI regular benefits, you will continue to receive them until the end of your benefit period.

- If you became eligible for EI on March 15 or later, your application will automatically be processed through CERB.

- If your EI benefits started before March 15 and end before Oct. 3, you can then apply for the CERB if you meet the eligibility requirements.

- After you stop receiving the CERB you can still receive EI if you are eligible. Further, the period for which you received the CERB does not affect your EI entitlement.

- If you have applied for EI but your claim has not been processed yet, you do not need to reapply for the CERB – you will continue to receive EI benefits if you became eligible for them before March 15. If you became eligible after March 15, your claim will automatically be processed under CERB.

If you are receiving maternity/parental or other special benefits and you cannot return to work after you finish collecting them due to reasons related to COVID-19, you may be eligible to apply for CERB.

You cannot be paid Employment Insurance benefits and the Canada Emergency Response Benefit for the same period.

On March 25, 2020, the Government of Canada announced a proposal to establish the Canada Emergency Response Benefit (CERB) to provide more effective support to Canadians.

The CERB is a simpler and more accessible combination of the previously released Emergency Care Benefit and Emergency Support Benefit.

- What is the CERB?

- A taxable benefit providing $2,000 a month for up to four months for workers who lose their income as a result of the COVID-19 pandemic

- Why is it being introduced?

- To help businesses keep their employees, to provide financial support to workers who are experiencing financial difficulties and would not otherwise qualify for Employment Insurance(EI) benefits, to support families in paying for essentials, and to stabilize the Canadian economy during the COVID-19 pandemic

- Who can apply?

- Canadians who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19, as well as working parents who must stay home without pay to care for children who are sick or at home because of school and daycare closures

- Wage earners, contract workers and self-employed individuals who would not otherwise be eligible for Employment Insurance (EI)

- Workers still employed but are not receiving income because of disruptions to their work situation due to COVID-19 also qualify for the CERB

- All Canadians who have ceased working due to COVID-19, whether they are EI-eligible or not, would be able to receive the CERB

- Employment Insurance (EI) and the CERB

- Canadians receiving EI regular and sickness benefits as of today would continue to receive their benefits and should not apply to the CERB. If your EI benefits end before October 3, 2020, you could apply for the CERB once your EI benefits cease, if you are unable to return to work due to COVID-19

- Canadians who have already applied for EI and whose application has not yet been processed would not need to reapply

- Canadians who are eligible for EI regular and sickness benefits would still be able to access their normal EI benefits, if still unemployed, after the 16-week period covered by the CERB

- EI eligible Canadians who have lost their job can continue to apply for EI

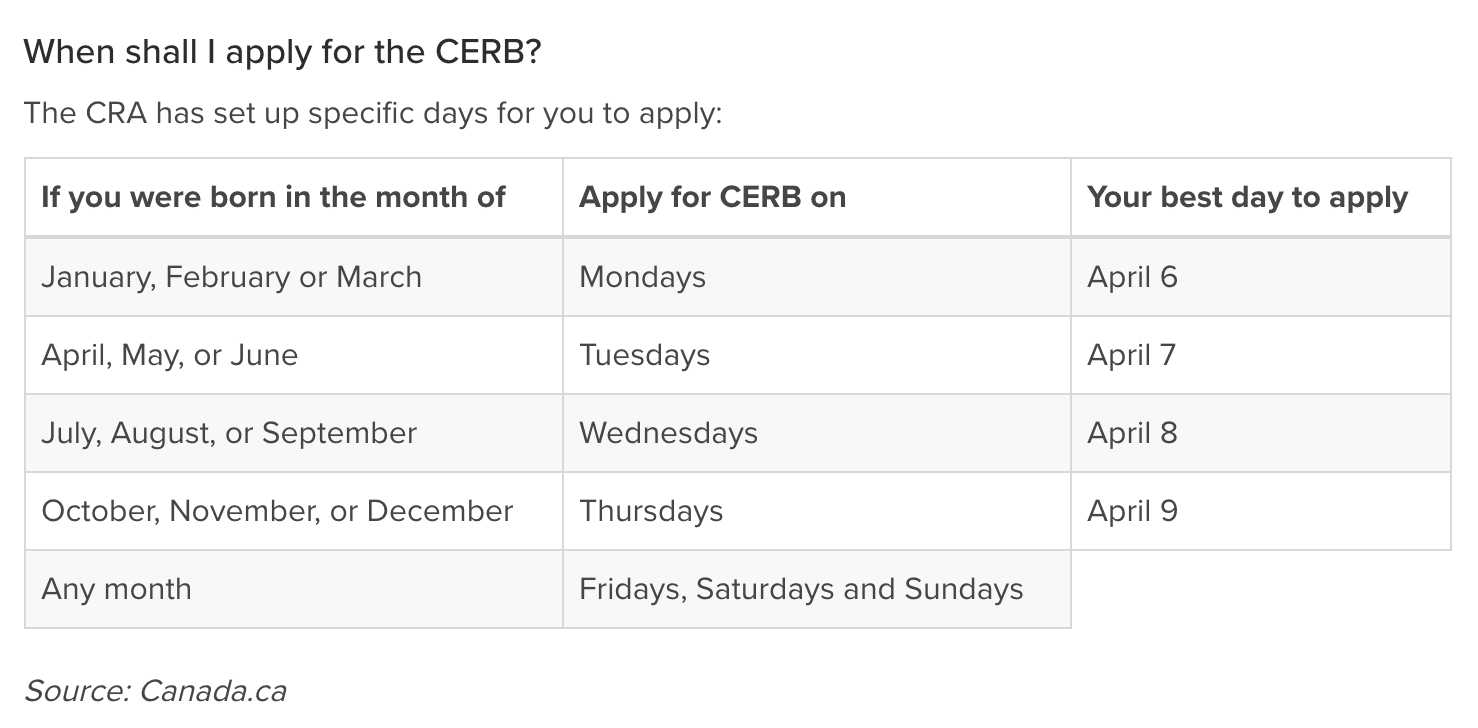

- How to apply & When can I receive my benefit?

- The portal for accessing the CERB will be available in early April

- CERB payments will begin within 10 days of application

- Payments made every four weeks and be available from March 15, 2020 until October 3, 2020

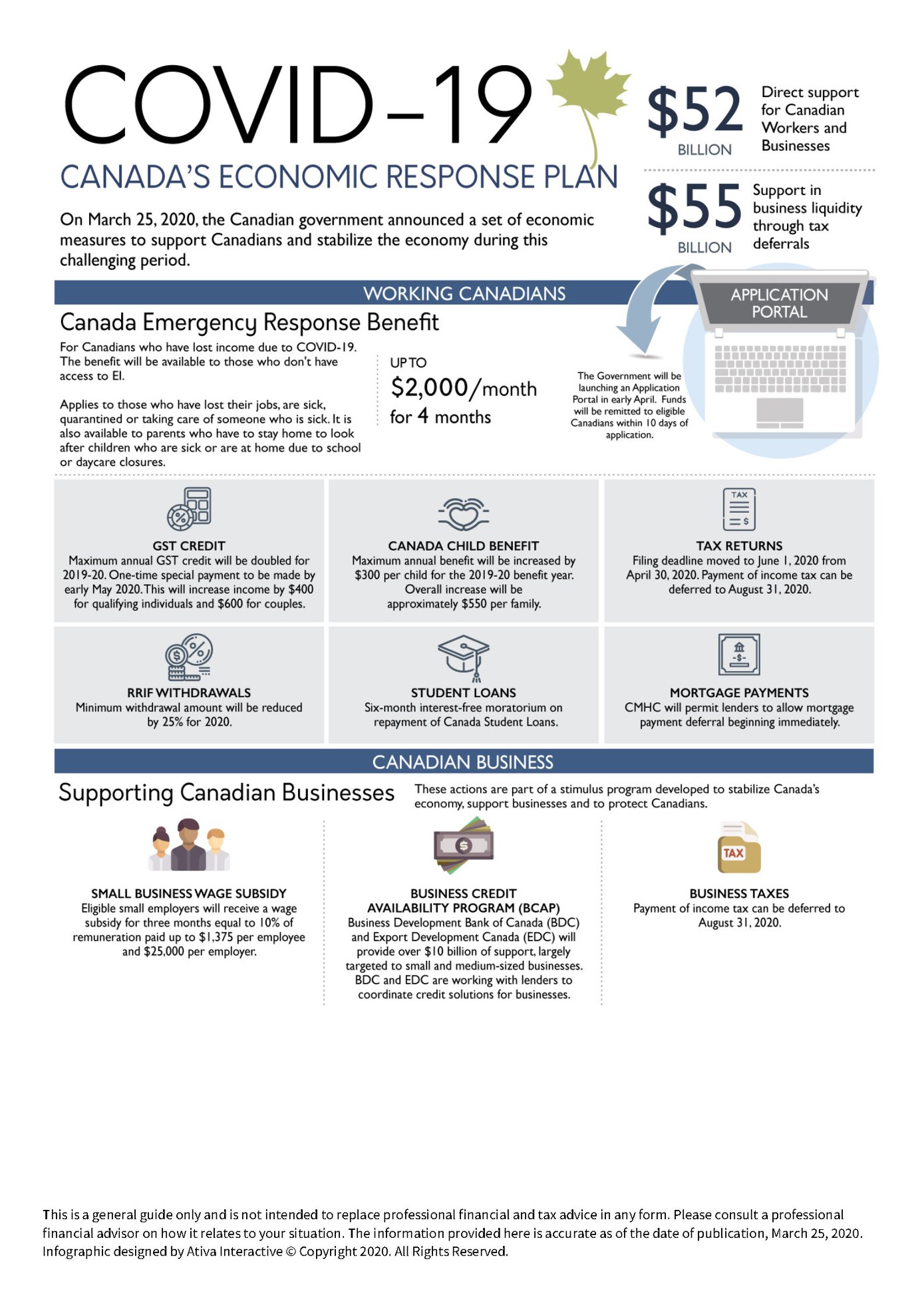

On March 18, 2020, Prime Minister Justin Trudeau announced an $82 billion economic stimulus package made necessary by COVID-19’s impact on Canada and the global economy. The stimulus, delivered as part of the Government of Canada COVID-19 Economic Response Plan, is aimed at helping individuals and businesses who face financial hardship given current developments. The economic stimulus will provide $27 billion in aid, with a further $55 billion in tax-deferral measures.

Direct stimulus for individual

Tax relief measures

- Reducing the required minimum withdrawals from Registered Retirement Income Funds (RRIFs) by 25% for 2020 in response to the financial impact of volatile market conditions on seniors’ retirement savings. We have seen a similar measure implemented in the past. We fully expect that RRIF annuitants who have already received more than 75% of their calculated RRIF minimum will be able to recontribute the excess back into their RRIF and claim a deduction. Of course, we’ll have to wait until the government introduces the final tax rules to fully understand whether this will be allowed and whether the measure is more targeted (for example, by RRIF annuitant age). Remember that seniors who do not need their RRIF withdrawals right away can transfer the taxable RRIF minimum payment into a Tax-Free Savings Account (TFSA) or non-registered account and keep it invested in the hope of a future recovery.

- Introducing a deferral of the individual income tax return filing due date to June 1, 2020, and a deferral of the trust income tax return filing due date to May 1, 2020 for trusts with a tax year ending on December 31, 2020.

- Deferring income tax payments until September 1, 2020. No interest or penalties will accumulate during this period. This measure will apply to all taxpayers.

- Temporarily accepting electronic signatures previously not accepted by the Canada Revenue Agency (CRA) to help ease the administrative burden during this period.

- Providing support for low- and modest-income families who need immediate financial assistance given the circumstances. This will be facilitated through a one-time special payment (by early May 2020) through the Goods and Services Tax Credit (GSTC). The measure calls for doubling the maximum annual GSTC payment, which will provide an estimated average boost of $400 for single individuals and $600 for couples.

- Increasing the maximum annual Canada Child Benefit (CCB) for families with children for the 2019–2020 benefit year. The proposal increases the benefit by $300 per child.

- Implementing a six-month freeze on interest payments related to the repayment of Canada Student Loans.

Emergency support and enhanced benefits

- Waiving the mandatory Employment Insurance (EI) one-week waiting period for individuals in quarantine due to COVID-19, effective March 15, 2020.

- Waiving the requirement for medical certificates to access EI sickness benefits.

- Introducing the Emergency Care Benefit (ECB), which will provide up to $900 in bi-weekly payments for up to 15 weeks. People will be able to apply for this benefit in April 2020 through CRA My Account, My Service Canada Account or a toll-free number with an automated application process. The benefit will require an attestation, reconfirmed every two weeks, that applicants meet the eligibility requirements. Facilitated by the CRA, this benefit targets:

- Workers and self-employed individuals who are quarantined or sick with COVID-19 but who do not normally qualify for EI benefits.

- Individuals who are taking care of a family member who is sick with COVID-19 but who do not normally qualify for EI sickness benefits.

- Parents with children who require care or supervision due to school closures and who are unable to earn employment income, irrespective of whether they qualify for EI or not.

- Introducing an Emergency Support Benefit for individuals who lose their jobs or face reduced hours. This program will also incorporate the March 11, 2020 announcement regarding the EI Sharing Program, which provides EI benefits to workers who agree to reduce their normal working hours because of developments beyond their employers’ control.

- Providing assistance to homeowners through the Canada Mortgage and Housing Corporation (CMHC) and other mortgage insurers, with options that may include payment deferral, loan reamortization, capitalization of outstanding interest and other special arrangements.

- Supporting individuals experiencing homelessness during the COVID-19 outbreak, and supporting women and children who are fleeing violence through additional funding to women’s shelters.

Direct stimulus for businesses

- Providing a temporary wage subsidy to eligible small employers for three months to support businesses facing revenue losses and help prevent layoffs. The subsidy will be equal to 10% of remuneration paid during the period, up to a maximum subsidy of $1,375 per employee and $25,000 per employer. Eligible small businesses are those eligible for the small business deduction, non-profits and charities.

- Deferring taxes due between today and September 2020 until September 1, 2020 for all businesses. This applies to tax balances due and instalments payable. No interest or penalties will accumulate during this period.

- Implementing a freeze on contacting small and medium-sized businesses regarding GST/HST or Income tax audits for the next four weeks.

- Introducing targeted measures to enhance credit for small and medium-sized businesses through the Business Credit Availability Program (BCAP). The BCAP includes industries most affected by COVID-19, including oil and gas, air transportation, and tourism.

- Injecting about $300 billion into Canadian banks.

- Recently reducing the Bank of Canada’s interest rate to 0.75% to support the Canadian economy in response to the economic toll of COVID-19 and recent sharp reduction in oil prices.

- Launching an Insured Mortgage Purchase Program (IMPP) that will provide $50 billion of insured mortgage pools through the CMHC.

As part of the rollout of the stimulus package, Minister of Finance Bill Morneau indicated that the government will do “whatever it takes” to minimize financial hardship for individuals, businesses and the economy.

Federal Government Announces 75% Wage Subsidy and Loan Program to Assist Small and Medium Businesses. March 27, 2020

- In a press conference on Friday, March 27, 2020, Prime Minister Justin Trudeau announced that the initial 10% wage subsidy implemented to help businesses adversely affected by COVID-19 was insufficient, and would be increased to 75% wage subsidy for qualifying businesses. The announced subsidy is intended to be backdated to March 15, 2020

- To be eligible for the former 10% subsidy, employers were expected to meet all of the following criteria:

- Be a non-profit organization, registered charity, or Canadian-controlled private corporation (CCPC);

- Have an existing business number and payroll program account with the CRA as of March 18, 2020; and

- Pay salary, wages, bonuses, or other remuneration to an employee.

- For CPCCs to be eligible, their taxable capital employed in Canada for the preceding tax year (calculated on an associate group basis) also must have been less than $15 million.

- While these same eligibility criteria are presumed to also be intended to apply to the new 75% wage subsidy, details of the program are still being worked out, and more information is expected to be released by Monday, March 30, 2020.

- The Prime Minister also announced today the launch of a new Canada Emergency Business Account for qualifying small business loans. Under this program, small and medium-sized businesses will be eligible for loans of up to $40,000. As well, GST, HST, and import duty payments will be deferred to the end of June. In total, this is equivalent to a $30 billion interest-free loan.

- The Prime Minister further indicated that he hoped these developments would help employers reconsider laying off workers and further encourage them to re-hire workers who had previously been laid off.

- More details will be provided as they become available.

Support for people who are sick, quarantined, or in directed self-isolation

The new Canada Emergency Response Benefit

We will provide a taxable benefit of $2,000 a month for up to 4 months to:

- workers who must stop working due to COVID-19 and do not have access to paid leave or other income support.

- workers who are sick, quarantined, or taking care of someone who is sick with COVID-19.

- working parents who must stay home without pay to care for children that are sick or need additional care because of school and daycare closures.

- workers who still have their employment but are not being paid because there is currently not sufficient work and their employer has asked them not to come to work.

- wage earners and self-employed individuals, including contract workers, who would not otherwise be eligible for Employment Insurance.

Application details will be available through My CRA and My Service Canada, beginning the first week of April.