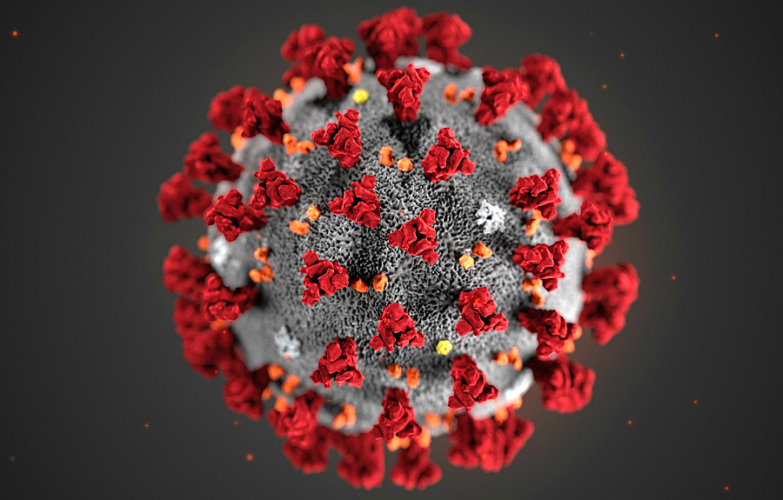

COVID-19 Government Support for Canadian Businesses

Visit this page to learn about COVID-19 Government Support for Canadian Businesses.

Browse the latest from Leap | ACT.

Visit this page to learn about COVID-19 Government Support for Canadian Businesses.

We would like to communicate our ongoing commitment to providing the same level of service you have come to expect from McEvoy Lelievre, during the COVID-19 pandemic.

Learn about our journey with using Xero cloud accounting software, and how we help businesses grow across Niagara and beyond.

In the article, we had the opportunity to share about our journey with Xero and give advice to others considering this amazing cloud-accounting platform.

Did you know that as a small business owner, you may be required to post no smoking & no vaping signage in your storefront or face a $5000 fine?

We can E-file your federal and NY state tax return, and we can quickly and effectively do critical follow-up when responding to review letters from the Canada Revenue Agency, where claiming the foreign tax credit is involved.

When putting your farm land up for sale, it is essential to make sure that the terms of real estate sale agreement are “excluding HST”!

The Qualified Farm Property exemption is available to farmers who sell their property, but only for the portion of land that qualifies as ‘farmed’.

A valid Farm Business Registration number (FBR number) will give you access to a number of benefits including lower property taxes and eligibility for OFA membership.

Contact-free virtual meetings are available at the click of a button.

Book A Consultation